Photo: Freeimages.com/T. Al Nakib

About Factset Research System

Factset Research System provides integrated applications that supply financial information to investment professionals around the world. Factset’s customers include portfolio managers; buy and sell-side equity research professionals; investment bankers; and fixed income professionals. The company, which was founded in 1978 and came public in 1996, is headquartered outside New York City in Norwalk, CT, has 38 offices across 21 countries, and employs nearly 8,000 people.

Factset’s integrated data platform (also named FactSet) provide access to a wide variety of securities information – some of it proprietary – on equities, mutual funds and fixed income securities. Additionally, the applications allow for multicompany comparisons, and portfolio analysis, optimization and simulation. Examples of data available through the platform include geographic revenue exposure, and ETF data and analytics. Factset generates most of its revenues from selling month-to-month subscriptions to its platform, the content and related services. At the end of March 2016, more than 62,000 users across 3,000 clients used the FactSet platform.

Factset reports company financials within 3 business segments, divided by geography: (1) United States; (2) Europe; and (3) Asia Pacific. The U.S. segment services customers throughout the Americas and provided two-thirds of the company’s total revenues in fiscal 2015 (which ended August 31, 2015). The European segment, which is headquartered in London, provided 25% of Factset’s fiscal 2015 revenues and the Asia Pacific segment provided the remaining 7.6% of fiscal 2015 revenues.

For fiscal year 2015, Factset saw good growth – revenues were up 9.4% to $1.0 billion, with U.S. revenues up 8.7% and international revenues up 10.9% year-over-year. Asia Pacific revenue growth led the way, up 15.5%. Currency effects, primarily from a weak Japanese Yen, reduced total international revenues by $3.4 million; excluding this, total international revenues would have been up 12.1%. The revenue growth in all segments was due to an increase in annual subscriber volume from client and user growth, particularly in the Europe and Asia Pacific segments, which has grown 31% annually since 2006.

Net income was up 13.9% in fiscal 2015 to $241.1 million, and fiscal 2015 earnings per share were up 16.1% to $5.71, giving the company a payout ratio of 30.8%. This is the 35th consecutive year of revenue growth and the 19th straight consecutive year of earnings growth as a public company.

The good performance shown by Factset in fiscal 2015 continued into the first quarter of 2016, with earnings per share up 8.3% year-over-year. The company also announced a $250 million expansion of its share repurchase program. With the additional funds, there are now $342.3 million available to repurchase shares. Assuming a share price of $150, Factset could repurchase up to 2.8 million shares, representing 5.5% of the number of shares outstanding. This would be in addition to the 1.7 million shares repurchased previously under the existing program.

Factset also provided earnings guidance for the 2nd quarter, estimating EPS between $1.49 – $1.53, an increase of 7 – 10% over the $1.39 earned in the 2nd quarter of fiscal 2015. This estimate relies on the renewal of the Federal Research & Development tax credit; if not renewed, 2nd quarter EPS would be reduced by 5 cents on both ends of the estimate.

The company is a member of the S&P Mid Cap 400 index and trades under the ticker symbol FDS.

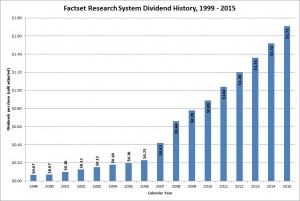

Factset Research System’s Dividend and Stock Split History

Factset Research has grown dividends each year-over-year since 1999. The company announces increases at the beginning of May, with the stock going ex-dividend at the end of May. The company’s most recent dividend increase (the 17th consecutive year of dividend growth) was in May 2015 when Factset announced a 12.8% increase in the quarterly dividend to an annualized $1.76.

Factset has an excellent record of dividend growth. Since 1999, the smallest year-over-year increase was 11.11% (in 2005). Over the last 5 and 10 years, Factset has compounded dividends at a rate of 13.95% and 23.94%, respectively. From 1999 – 2015, the average compounded growth rate is 22.49%

Factset Research has split its stock three times since coming public in 1996. The first split was a 3-for-2 split in February 1999, followed by a 2-for-1 split in February 2000 and another 3-for-2 split in February 2005. One share of Factset Research stock purchased at the initial public offering would now have split into 4.5 shares.

Over the 5 years ending on December 31, 2015, Factset Research stock appreciated at an annualized rate of 12.99%, from a split-adjusted $88.29 to $162.57. This outperformed both the 10.20% compounded return of the S&P 500 index and the 9.04% compounded return of the S&P Mid Cap 400 index over the same period.

Factset Research System’s Direct Purchase and Dividend Reinvestment Plans

Factset Research does not have a direct purchase or dividend reinvestment plan. In order to invest in Factset Research stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Factset Research System’s Investor Relations Website

Current quote and financial summary for Factset Research System (finviz.com)