Harris designs and manufactures a variety of defense and space hardware. Photo: Freeimages.com/Michel Meynsbrughen

About Harris Corporation

Harris Corporation is an engineering firm with a focus on defense and public safety applications. The company employs more than 22,000 people and has customers in more than 125 countries. Harris’ largest customers are the United States Government and its prime contractors, along with foreign militaries and governments that purchase equipment with U.S. Government funding.

Harris is the successor to 3 companies with heritage dating back to the 1890s. At that time, Alfred and Charles Harris created Harris Corporation as a jewelry store. According to the company website, they also experimented with gadgets and their first invention was an automatic sheet feeder for printing presses. On December 23, 1895, they incorporated the Harris Automatic Press Company.

In 1957, Harris (now called Harris-Seybold) merged with Intertype Corporation to form Harris-Intertype. The company moved from teletype systems to radio frequency communications systems in 1967, when it added broadcasting and microwave communications engineering to its capabilities. It also acquired Radiation Inc., a manufacturer of space and military technology. Ultimately, in 1974, the company changed its name back to Harris Corporation.

Harris has 4 business segments: Communication Systems, which serves markets in tactical and airborne radios, night vision technology, and defense and public safety networks; Critical Networks, which provides managed services that support air traffic management, energy and maritime communications, and ground network operations and sustainment; Electronic Systems, which provides engineered systems for electronic warfare, avionics, wireless technology, undersea systems and aerostructures, and command and control systems; and Space and Intelligence Systems, which provides engineered systems for Earth observation, geospatial-intelligence, space protection, along with advanced sensors and payloads.

The company is a member of the S&P 500 index and trades under the ticker symbol HRS.

Harris Corporation’s Dividend and Stock Split History

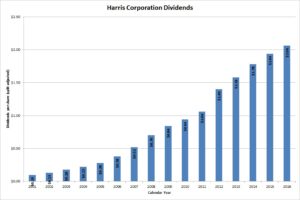

Harris has paid dividends since at least 2000 and grown them since 2002. The company generally announces dividend increases in late August, with the stock going ex-dividend in early September. In August 2016, the company announced a 6.0% increase to its payout, to an annualized rate of $2.12 per share.

Harris has an outstanding record of dividend growth, despite the modest 2016 increase. From 2002 – 2015, the company consistently compounded the dividend by double digits each year. Over the last 5 and 10 years, Harris compounded dividends at 14.21% and 18.42% respectively. Since beginning its record of dividend growth in 2001, Harris has compounded its dividend at 22.35%.

Harris has split its stock several times in its 100+ year history. The most recent split was in March 2005, when the company split the stock 2-for-1. Prior to that, there were 2-for-1 splits in September 1997, September 1978, December 1976 and September 1964, and a 3-for-2 split in September 1960. The company has also issued stock dividends over its history: 10% stock dividends in September 1962, February 1950 and November 1948; a 50% stock dividend in January 1955; a 5% stock dividend in December 1953; a 7.5% stock dividend in November 1952; a 15% stock dividend in December 1951; and a 20% stock dividend in December 1950.

Over the 5 years ending on December 31, 2015, Harris Corporation stock appreciated at an annualized rate of 16.85%, from $39.39 to $85.81. This outperformed the 10.20% compounded return of the S&P 500 index over the same period.

Harris Corporation’s Direct Purchase and Dividend Reinvestment Plans

Harris Corporation has both direct purchase and dividend reinvestment plans. However, to participate in either plan, you must be a current shareholder. That means that you must own shares in your own name and not that of your brokerage (i.e., “in street name”). If you do own shares in a brokerage account, you’ll have to have them transferred into your name and then deposited into the plan to begin participating.

Once enrolled, the minimum amount for additional investments is $40.

The plans are very favorable for investors, as the company picks up most of the fees for purchases. There are no fees when you purchase shares through the plan, either directly or through dividend reinvestment. When you sell your shares in the plan, you’ll pay a fee of $15 or $25 per sell order (depending on the type of sell order requested) along with a 12 cent per share commission. In addition, if you place your sell order through a customer service representative on the phone, you’ll pay an additional $15 fee. All fees will be deducted from the sales proceeds.

Helpful Links

Harris Corporation’s Investor Relations Website

Current quote and financial summary for Harris Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Harris Corporation