IBM provides information technology consulting and business process services to companies worldwide. Photo: Freeimages.com/Whrelf Siemens

About IBM

International Business Machines Corporation provides information technology consulting and business process services to businesses in 175 countries worldwide. IBM’s heritage dates back to June 1911, when the Computing-Tabulating-Recording Company was formed from the merger of Computing Scale Company of America, the Tabulating Machine Company and The International Time Recording Company of New York. The company changed its name to International Business Machines Corporation in 1924. IBM is headquartered in New York State.

IBM helps clients use analytics to exploit data and cloud-based services to serve their customers, along with helping its clients engage with customers that now have more data available to them than ever before. Broadly speaking, IBM’s business model is to help its clients increase their revenue by exploiting advances in information technology. The company does this by employing both IBM proprietary and 3rd party systems and software, and building IT infrastructure to take advantage of the increases in the data available to companies. Much of IBM’s revenue is annuity based, allowing for recurring revenue.

IBM’s major competitors include Amazon, Alphabet, Hewlett-Packard, Dell, Microsoft, Oracle, Salesforce.com, and SAP.

The company is a member of the S&P 500 and Dow Jones Industrial indices and trades under the ticker symbol IBM.

IBM’s Dividend and Stock Split History

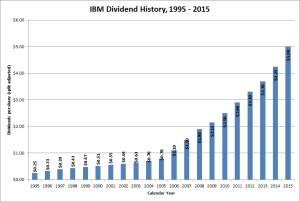

IBM has paid dividends since 1916 and grown them year-over-year since 1996. The company generally announces annual dividend increases at the end of April, with the stock going ex-dividend at the beginning of May. The company’s most recent dividend increase was in April 2015 when IBM increased its dividend payout by 18.1% to an annualized $5.20.

IBM has an excellent record of dividend growth, with year-over-year increases of at least 10% since 2004. The company’s 5 and 10-year compounded dividend growth rates are 14.87% and 20.42%, respectively. Since 1995, IBM’s compounded dividend growth rate is 16.16%.

Since 1925, IBM has split its stock 14 times and issued 26 stock dividends. The most recent splits were in May 1997 and May 1999, when the company split its stock 2-for-1. Prior to that, IBM had not split its stock or issued a stock dividend since May 1979. A single share of IBM stock purchased when the company began its recent streak of year-over-year dividend growth in 1996 would now have quadrupled to 4 shares.

Over the 5 years ending on December 31, 2015, IBM stock has been nearly flat, appreciating at an annualized rate of 0.83% from $130.70 to $136.23. This significantly underperformed the 10.20% compounded return of the S&P 500 index and the 8.52% compounded return of the Dow Jones Industrial index over the same period.

IBM’s Direct Purchase and Dividend Reinvestment Plans

IBM has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in the plans. The minimum initial investment for new participants is $500. The minimum direct purchase amount for existing participants is $50. You can choose to reinvest all, none or a portion of your dividends.

The plans’ fees are significant. New participants will pay an enrollment fee of $10. When making direct purchases, you’ll pay a fee of $5 when investing by check or one-time bank debit, or a fee of $1 when investing by automatic bank debit. The fee on dividend reinvestment is 2% of the amount reinvested, up to $3. Finally, when you go to sell your shares, you’ll pay a transaction fee of $15 or $25, depending on the type of sell order, plus a commission of 10 cents per share. All of these fees will be deducted from the sale proceeds.

Helpful Links

IBM’s Investor Relations Website

Current quote and financial summary for IBM (finviz.com)

Information on the direct purchase and dividend reinvestment plans for IBM