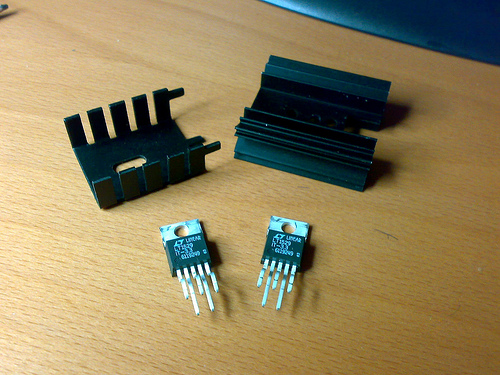

This 3 volt regulator is among the products that Linear Technology provides to its customers. Photo courtesy meteotek08/flickr.com.

Note: Analog Devices recently announced plans to acquire Linear Technology Corporation. The acquisition will likely close in late 2016 or early 2017.

About Linear Technology Corporation

Linear Technology Corporation manufactures high performance analog integrated circuits for a variety of applications including networking, robotics, power management, and military and aerospace systems. The company has its headquarters in Milpitas, California, in Silicon Valley, and more than 4700 employees around the world.

Linear Technology markets more than 7500 products to 15000 original equipment manufacturers and maintains sales and technical support facilities around the world. Linear also has 10 design centers in the United States and 3 others around the world – in Singapore, Munich, Germany, and Hangzhou, China. The company’s intellectual portfolio includes more than 1000 patents.

Linear’s business comes primarily from three major business lines: Industrial, Automotive and Communications. The Industrial business segment is 43% of Linear’s business (2014 numbers), which is up from 35% in 2009, and serves the medical imaging, robotics, energy management and factory automation markets, among others. The Communications business segment is 20% of total company business, down from 29% in 2009. This business segment manufactures products for networking servers and routers, power over Ethernet products, cellular basestations and phones, wireless sensor networks, and satellite communication systems. Finally, the Automotive business segment is 19% of Linear’s 2014 business, up from 8% in 2009. This segment manufactures ICs in support of automated systems that are incorporated into vehicles, such as collision avoidance and emissions control systems.

The company’s major competitors are Analog Devices, Intersil, Maxim Integrated Products and Texas Instruments.

During the company’s 2014 fiscal year (FY) (which ends June 30th, 2014), Linear Technology had revenues of $1.4 billion, up 8.3% from FY 2013. Net income was $460 million, up 13% from FY 2013, and earnings per share were $1.90, up 11.1% from FY 2013.

The company is a member of the S&P 500 index and S&P’s High Yield Dividend Aristocrats index, and its common stock trades under the ticker symbol LLTC.

As a member of the S&P 500, once Linear Technologies has increased dividends for 25 consecutive years S&P will classify the company as an S&P Dividend Aristocrat. Given that the company has made a conscious effort to increase the dividend each year for 23 years straight, I expect them to continue to do so. This would put them on track to become a Dividend Aristocrat in 2017.

Linear Technology Corporation’s Dividend and Stock Split History

Linear Technology has increased dividends since 1993. The company traditionally increases its dividend in the first quarter of the calendar year, with the announcement coming in January, and the stock going ex-dividend and the payment coming in February. In January 2015, Linear Technology increased its quarterly dividend by 3 cents, or 11.1%, to an annualized rate of $1.20 per share. I expect the company to announce its next dividend increase in January 2016.

After aggressively growing its dividend from 1993 – 2008, Linear slowed the dividend growth to the low single digit percentages from 2009 – 2014. The company’s 5-year compounded annual dividend growth rate (CADGR) is 5.46%, but the longer term CADGRs are much higher, with the 10-year CADGR at 11.61% and the 20-year CADGR at 18.92%.

Since beginning its record of dividend growth in 1993, Linear Technology has split its stock 4 times, each 2-for-1. The stock splits occurred in November 1992, September 1995, February 1999, and February 2000. For each share of stock you owned at the beginning of 1993, you would now have 16 shares of Linear Technology stock.

Over the 5 years ending on December 31, 2014, Linear Technology stock appreciated at an annualized rate of 11.50%, from a split-adjusted $26.46 to $45.60. This underperformed both the 13.0% annualized return of the S&P 500 and the 14.9% annualized return of the S&P Mid Cap 400 index during this time.

Linear Technology’s Direct Purchase and Dividend Reinvestment Plans

Linear Technology does not have a direct purchase or dividend reinvestment plan. In order to invest in Linear Technologies’ stock, you’ll need to purchase it through a broker. Most brokers will allow you to reinvest dividends without any fee. Ask your broker for more information on how to set this up if you are interested.

Helpful Links

Linear Technology Corporation’s Investor Relations Website

Current quote and financial summary for Linear Technology Corporation (finviz.com)

Want to find out about more great dividend growth stocks?

Check out the list of current S&P Dividend Aristocrats.