Roundup is one of Monsanto's well-known brands worldwide. Photo: Flickr.com/Mike Mozart

About Monsanto Company

Monsanto Company is a provider of products and technologies that help farmers worldwide improve their crop yield. These products include genetically modified seeds and chemical herbicides. Roughly 45% of Monsanto’s total sales come from outside the United States. The company is headquartered in St. Louis, Missouri and employs over 25,000 people.

Monsanto reports its business in two distinct business segments: Seeds and Genomics, and Agricultural Productivity. The Seeds and Genomics segment produces genetically modified seeds. These are crop seeds that have genetic traits that improve resistance to insects and weeds, reducing the need for insecticides and anti-weed products. The segment also provides other seed companies with genetic material for their seed brands. Monsanto produces seeds for a variety of crops, including corn, soybeans, cotton, canola, tomato, pepper, melon, cucumber, beans, and broccoli. The Seeds and Genomics segment provides about 70% of Monsanto’s total sales and 75% of Monsanto’s total profit, and is viewed as the major growth driver for the company.

The Agricultural Productivity segment manufactures herbicides under the Roundup, Harness and other brands. Monsanto also markets its products through The Scotts Miracle-Gro Company. The Agricultural Productivity segment generates the remainder of Monsanto’s sales and profit – about 30% of the company’s total sales and 25% of the company’s total profit.

There are a couple of significant risks that potential investors in Monsanto should be aware of. First, one major risk for Monsanto is the concentration of company sales in its top distributors. Monsanto’s four largest U.S. distributors represent 20% of worldwide net sales and 35% of U.S. net sales, and the largest U.S. distributor represented 11% of worldwide and 18% of U.S. sales for the Seeds and Genomics segment. Another risk for Monsanto are the regulations and public opinion regarding genetically modified organisms (GMOs). Both of these can potentially raise Monsanto’s cost of doing business and negatively affect sales.

The company is a member of the S&P 500 index and trades under the ticker symbol MON.

As a member of the S&P 500, once Monsanto has increased dividends for 25 consecutive years S&P will classify the company as an S&P Dividend Aristocrat. Given that Monsanto has made a conscious effort to increase the dividend each year for 17 years straight, I expect them to continue to do so. This would put them on track to become a Dividend Aristocrat in 2024.

Monsanto Company’s Dividend and Stock Split History

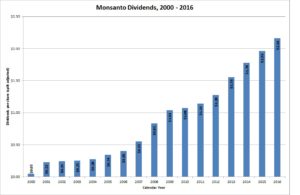

Monsanto initiated dividends in 2000 and grown them since then. From 2010 – 2014, Monsanto increased its dividend in the 4th quarter of the calendar year. However, the company’s most recent dividend increase was announced in early December 2015, when Monsanto raised the dividend by 10.2% to an annual rate of $2.16. The stock went ex-dividend in early January 2016.

Monsanto has built an excellent record of dividend growth. Over the last 5 and 10 years, the company has compounded dividends at average rates of 13.63% and 18.37%, respectively. Since the company’s first full year of dividends in 2001, Monsanto has compounded the dividend at an average rate of 16.27%.

Since initiating the dividend in 2000, Monsanto has split its stock once: a 2-for-1 split in July 2006.

Over the 5 years ending on December 31, 2015, Monsanto Company stock appreciated at an annualized rate of 8.86%, from a split-adjusted $63.68 to $97.36. This underperformed the 10.20% compounded return of the S&P 500 index over the same period.

Monsanto Company’s Direct Purchase and Dividend Reinvestment Plans

Monsanto Company has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in either plan – you can make your first investment through the direct purchase plan with an initial purchase of $250 or 10 monthly automatic debits of $25. The dividend reinvestment plan allows for partial reinvestment of dividends.

The plans’ fee structures are not favorable for investors. First, you’ll pay a fee of $15 to establish an account at Computershare, if you don’t already have an account. When purchasing shares directly, you’ll pay a commission of 6 cents per share plus a transaction fee of $2 for online bank debits and $5 for purchases by check. When you reinvest your dividends, you’ll pay 6 cents per share plus a transaction fee of 5% of the amount reinvested up to a maximum of $3.

When you go to sell your shares, you’ll pay a commission of 12 cents per share plus a transaction fee of $15 or $25, depending on the type of sell order. You’ll also pay a fee of $15 if you place your sell order through a customer service representative. All fees are deducted from the sales proceeds.

Helpful Links

Monsanto Company’s Investor Relations Website

Current quote and financial summary for Monsanto Company (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Monsanto Company

Thanks for the analysis. I’ve not researched Monsanto before. It looks like they have focused on dividend increases, something I like to see.

Thanks for the kind comment, Investment Hunting.

Cheers,

Jason

Hi,

There are news that Bayer AG from Germany is planning to buy MON.

I think from a dividend investor perspective the stock of Bayer is also nice (when they will pay in stock).

kind regards

valuetradingblog.com