Among the items that Nordson builds is testing equipment for printed control boards like the one shown above. Photo courtesy Shal Farley/flickr.com.

About Nordson Corporation

Nordson Corporation designs, manufactures and markets products and systems used to apply adhesives and coatings, conduct post-application quality checks, and cure surfaces in a variety of applications and markets. The company, with headquarters in Ohio, sells its products in markets around the world and generates about 70% of its revenues outside the United States. Nordson has manufacturing facilities in North America, Europe and the Asia Pacific region, including China, India, Germany, the United Kingdom and Thailand.

Nordson has nearly 6,000 employees worldwide and has a significant intellectual property portfolio, with over 500 U.S. patents and nearly 1,200 international patents.

Nordson groups its business into three business segments: Adhesive Dispensing Systems, Advanced Technology Systems and Industrial Coating Systems. The Adhesive Dispensing Systems segment is responsible for the products and systems that dispense and apply adhesives and sealants. This segment serves multiple markets including child-training pants and diapers, pharmaceutical packaging, food & beverage packaging, furniture and electronics.

The Advanced Technology Systems segment is responsible for the design and manufacture of quality control processes and technologies, and inspection and test technologies. Markets served include electronics and medical industries; for example, this segment produces x-ray inspection systems used in the semiconductor and printed control board industries.

The Industrial Coating Systems segment produces equipment for applying coatings, paint and finishes. This segment serves the beverage industry, along with the aerospace, automotive and electronic industries.

The company is a member of the S&P Mid Cap 400 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol NDSN.

Nordson Corporation Dividend and Stock Split History

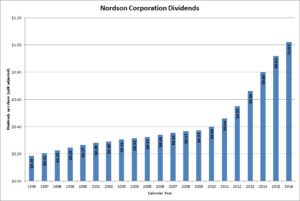

Nordson has increased its dividend payout year-over-year since 1964. Since 2009, the company has announced dividend increases in mid-August, with the stock going ex-dividend towards the end of August. Nordson’s most recent increase was a 12.5% increase in August 2016 to an annualized rate of $1.08 per share. I expect Nordson to announce its 54th year of dividend increases in August 2017.

After a stretch from 1998 – 2010 of dividend growth below 10%, Nordson has accelerated its dividend payout. Since 2011, the year-over-year dividend increases have been in the double digits, giving the company a 5-year average dividend growth rate of 17.27%. This puts Nordson in the select group of companies that have doubled their dividends from 2011 – 2016. Over the last 10 and 20 years, Nordson has compounded its dividend at rates of 11.61% and 8.91%, respectively.

Nordson Corporation has split its stock 2-for-1 three times. Splits occurred roughly once a decade beginning in September 1991, with additional splits in September 2001 and April 2011. A single share of stock purchased prior to September 1991 would have split into 8 shares.

Over the 5 years ending on December 31, 2015, Nordson Corporation stock appreciated at an annualized rate of 7.75%, from a split-adjusted $43.87 to $63.73. This underperformed both the 10.2% annualized return of the S&P 500 and the 9.0% annualized return of the S&P Mid Cap 400 index during this time.

Nordson Corporation Direct Purchase and Dividend Reinvestment Plans

Nordson Corporation has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in the direct purchase plan, but your initial investment must be a single purchase of at least $250 or 5 monthly purchases of at least $50.

The fee structure of the plans is not favorable to investors. If you are not currently participating in the plan, you will need to pay an initial setup fee of $10 when you enroll. When purchasing shares under the direct purchase plan, you’ll pay a transaction fee of $5 and a commission of 5 cents per share unless you set up regular automatic debits from your checking or savings account. In that case, the transaction fee is reduced to $2.50. (All other fees stay the same.) When you purchase shares by reinvesting dividends, your transaction fee will be 5% of the amount reinvested to a maximum of $3, plus a commission of 5 cents per share.

When you go to sell your shares in the plan, you’ll pay a transaction fee of between $15 and $25 and a commission of 12 cents per share. You’ll also be charged an additional fee of $15 for making the request through a phone representative. Unfortunately, these are standard fees for Computershare-run direct purchase and dividend reinvestment plans.

Helpful Links

Nordson Corporation’s Investor Relations Website

Current quote and financial summary for Nordson Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Nordson Corporation