Omega Healthcare invests in long-term healthcare facilities in the U.S. and U.K. like this Assisted Living Facility in Tacoma, Washington. Photo: Flickr.com/Michael D. Martin

About Omega Healthcare Investors

Omega Healthcare Investors is a real estate investment trust (REIT) that provides financing and capital to long-term healthcare facilities, specifically skilled nursing facilities (SNFs) and assisted living facilities (ALFs). The company has leases on or loans to about 950 healthcare facilities, including nearly 800 SNFs and nearly 100 ALFs. In general, the company seeks to obtain either long-term, “triple-net” leases and/or fixed-rate loans on healthcare facilities.

The company is a member of the S&P Mid Cap 400 index and trades under the ticker symbol OHI.

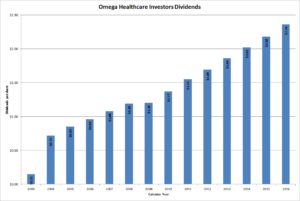

Omega Healthcare Investors‘ Dividend and Stock Split History

Except for 2001 and 2002, Omega Healthcare has paid dividends continuously since 1992 and grown them every year since 2003. Since the middle of 2012, the company has increased its dividend every quarter. The company announces dividend payments in January, April, July and October, with the stock going ex-dividend later in the same month as the announcement. As of October 2016, Omega Healthcare has an annualized dividend of $2.44.

Omega Healthcare has a consistent record of dividend increases, with growth rates of 8.77% over the last 5 years and 9.41% over the last 10 years.

Omega Healthcare has not split its stock in its history.

Over the 5 years ending on December 31, 2015, Omega Healthcare stock appreciated at an annualized rate of 16.44%, from $15.50 to $33.18. This nicely outperformed the 10.20% compounded return of the S&P 500 index over the same period.

Omega Healthcare Investors’ Direct Purchase and Dividend Reinvestment Plans

Omega Healthcare has both direct purchase and dividend reinvestment plans. If you are not a current shareholder, you can participate in the plan with an initial purchase of $250. Once you are a plan participant, the minimum investment is $50. The dividend reinvestment plan allows for full or partial reinvestment of dividends.

The plans are very favorable to investors. There is no enrollment fee and there is no fee if you purchase shares directly or through dividend reinvestment from the company, as opposed to on the open market. If the shares are purchased on the open market, you will have to pay standard commissions and fees. Whether your purchases are from shares on the open market or from the company is subject to Omega Healthcare’s discretion. In addition, Omega Healthcare offers a discount of between 0% and 3% on share purchases; the discount is currently 1%. As an investor, you should note that the discount on shares is taxable in the year when you purchase the stock.

When you go to sell your shares, you’ll pay a transaction fee of $15 or $25 (depending on the type of sell order), plus a commission of 12 cents per share. All fees will be deducted from the sales proceeds.

Helpful Links

Omega Healthcare Investors’ Investor Relations Website

Current quote and financial summary for Omega Healthcare Investors (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Omega Healthcare Investors