Piedmont Natural Gas provides natural gas service to over 1 million customers across the Carolinas and Tennessee. Photo courtesy Ervins Strauhmanis/flickr.com.

About Piedmont Natural Gas, Inc.

Piedmont Natural Gas provides natural gas and related energy services for more than 1 million customers in North Carolina, South Carolina and Tennessee. Piedmont began operations in 1951 and began paying quarterly dividends in 1956. The company employs nearly 1,900 people and has its headquarters in Charlotte, North Carolina.

Piedmont’s operations are organized across three business segments: Regulated Utility operations, Regulated Non-Utility Activities, and Unregulated Non-Utility Activities. Regulated Utility operations provide Piedmont generates the vast majority of its earnings and assets. In fiscal year 2014 (ended October 31, 2014), the Regulated Utility segment, whose primary business is selling natural gas to residential and commercial customers, provided 86% of total company earnings and held 96% of total company assets.

The Regulated Non-Utility Activities and Unregulated Non-Utility Activities segments generate revenue through investments in joint venture businesses held by Piedmont subsidiaries. These joint ventures are generally liquefied natural gas storage or natural gas pipeline businesses. Piedmont continues to invest in additional joint ventures – the company has agreements to invest in Constitution Pipeline Company, LLC and Atlantic Coat Pipeline, LLC, both of which are developing and will operate interstate natural gas pipelines. Constitution is building 120 miles of pipeline to connect gas supplies in Pennsylvania to transmission systems in New York State and Atlantic Coast is building a 550-mile pipeline to connect supplies in West Virginia to eastern North Carolina. The total investment by Piedmont for both joint ventures is $625 – 675 million.

Piedmont saw growth in fiscal year 2014, with operating revenues up 15.0% to $1.47 billion. This was offset by a nearly 19% increase in the cost of gas; net income ended up 7.0% to $143.8 million. The revenue growth was due to a 1% increase in the customer base, along with delivering higher volumes of natural gas to customers in Tennessee and South Carolina due to colder than normal weather. Earnings per share were only up 3.4% to $1.84 due to a 4% increase in the number of shares outstanding.

Although Piedmont has repurchased stock in the past, the company did not buy back stock in fiscal years 2013 or 2014, and does not anticipate repurchasing stock in 2015.

The company is a member of the S&P Small Cap 600 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol PNY.

Piedmont Natural Gas, Inc.’s Dividend and Stock Split History

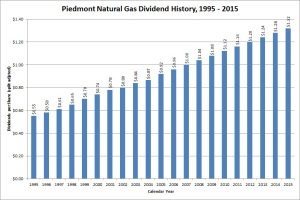

As mentioned above, Piedmont Natural Gas has paid quarterly dividends since 1956; the company has increased them annually since 1979. The company generally announces annual dividend increases at the beginning of March, with the stock going ex-dividend about three weeks later. Piedmont’s last dividend increase was a 3.1% bump to an annualized rate of $1.32. I expect Piedmont to continue the pattern of 1st quarter dividend increases and announce its 38th annual increase in March 2016.

Like most utility companies, Piedmont has a record of slow and steady dividend increases. For the last 10 years, the company has increased the dividend by 4 cents per year, resulting in 5-year and 10-year compounded annual dividend growth rates (CADGRs) of 3.34% and 3.68%, respectively. The 25-year CADGR is only slightly higher at 4.69%.

Piedmont has split its stock 3 times, each time 2-for-1. The splits occurred in March 1986, March 1993, and October 2004. A single share of stock purchased prior to March 1986 would have split into 8 shares since then.

Over the 5 years ending on December 31, 2014, Piedmont Natural Gas stock appreciated at an annualized rate of 11.98%, from a split-adjusted $22.18 to $39.06. This underperformed both the 13.0% annualized return of the S&P 500 and the 15.9% annualized return of the S&P Small Cap 600 index during this time.

Piedmont Natural Gas’ Direct Purchase and Dividend Reinvestment Plans

Piedmont has both direct purchase and dividend reinvestment plans. You do not need to be a current shareowner to participate in the direct purchase plan, but there is a $15 initial set up fee. Aside from this fee, Piedmont pays all the other fees on purchases through either plan. The minimum investment for new investors is $250.

When you sell your shares in the plan, you’ll pay a transaction fee of between $15 and $30, plus a brokerage fee of 12 cents per share. There’s an additional $5 fee to have the proceeds electronically deposited into your account.

Helpful Links

Piedmont Natural Gas’ Investor Relations Website

Current quote and financial summary for Piedmont Natural Gas (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Piedmont Natural Gas