Praxair builds on-site industrial gas factories under 10-20 year contracts for large-demand customers Photo courtesy Ed Kohler/flickr.com.

About Praxair

Praxair is a worldwide supplier of industrial gases for multiple markets. The company’s primary products are atmospheric gases, which are produced from air (e.g., oxygen and nitrogen) and process gases, which are produced through additional processes (e.g., carbon dioxide, hydrogen, and acetylene). In addition to the industrial gases business, Praxair also supplies wear-resistant and high-temperature coatings and powders under the Praxair Surface Technologies business segment. Praxair was formed and began trading as a public company when Union Carbide spun-off their Industrial Gases subsidiary in June 1992.

Praxair distributes industrial gases through three primary methods. For high volume customers with a consistent demand, Praxair builds factories at or near the customer site to deliver industrial gases with 10 – 20 year contract terms. For customers with moderate demand, Praxair makes deliveries by tanker truck from local plants directly to the customer sites. Deliveries are stored in containers that are leased by the customer from Praxair under 3 – 5 year contracts. Finally, smaller customers can pick up cylinders of industrial gases from retail outlets or have them shipped from Praxair plants. These purchases are generally done either under 1 – 3 year contracts or by purchase order. Each of these methods contributed roughly equal amounts to Praxair’s total sales in 2014.

The company’s sales are diversified across multiple industries. The top three industries as a percentage of 2014 sales are Manufacturing (24%), Metals (17%) and Energy (14%). Sales in 2014 totaled $12.2 billion, which was up nearly 3% year-over-year. 2014 earnings per share were $5.73, giving the company a payout ratio of 45.4%. In its latest annual report, Praxair noted that it expects 2015 sales to be roughly flat and earnings per share to be up 7 – 13% to between $6.15 and $6.50.

The company’s customers are also well diversified geographically. Praxair is the largest industrial gas supplier in North and South America, and has large businesses in Europe and Asia. North American sales contributed more than half of Praxair’s total sales in 2014, with European, South American and Asian sales each contributing about 15% of company sales. With the emphasis on international sales, the company reported in its annual report that currency effects reduced sales by 3% and operating profit by 7% in 2014.

In addition to its dividend growth, Praxair also uses its free cash flow to maintain an active share repurchase program. In January 2014, the company authorized $1.5 billion for share repurchases. To date, Praxair has bought nearly $500 million of stock, including 2.4 million shares in the 4th quarter of 2014. There’s no expiration date on this share repurchase program, so the remaining $1 billion can be used at any time going forward.

The company is a member of the S&P 500 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol PX.

As a member of the S&P 500 index, Standard & Poor’s should designate Praxair as an S&P 500 Dividend Aristocrat once the company has raised dividends for 25 consecutive years. I believe that Praxair will continue to raise dividends going forward, which means that it will become a Dividend Aristocrat at the beginning of 2019.

Praxair‘s Dividend and Stock Split History

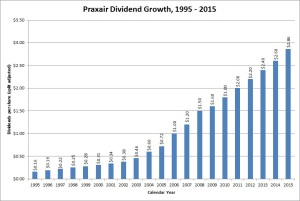

Praxair has paid dividends since becoming an independent company in 1992 and has grown its dividend each year since 1994. For the last decade, the company has announced dividend increases at the end of January and the stock has gone ex-dividend for the increase at the beginning of March. In January 2015, Praxair announced a 10% increase to an annualized rate of $2.86. I anticipate that the company will continue this trend and announce its 23rd annual increase in January 2016.

Praxair has an outstanding record of dividend growth. The company has grown its dividend year-over-year at least 10% in 18 of the 22 years of dividend growth. From 2010 – 2015, Praxair compounded its dividend at a rate of 9.7%. Over the last 10 years and 20 years, the dividend has been compounded at a rate of 14.79% and 11.57%, respectively.

Since being spun off from Union Carbide Corporation in June 1992, Praxair has split its stock once. This split, which occurred in December 2003, was 2-for-1.

Over the 5 years ending on December 31, 2014, Praxair stock appreciated at an annualized rate of 12.3%, from a split-adjusted $72.06 to $128.84. This underperformed the 14.9% annualized return of the S&P 500 index during this time.

Praxair‘s Direct Purchase and Dividend Reinvestment Plans

Praxair has both direct purchase and dividend reinvestment plans. However, you must be a registered shareholder to participate in either plan. If you hold shares of Praxair stock through your broker, you are not considered to be a registered shareholder; you must have your broker transfer the shares into your name and then have them deposited into the Praxair dividend reinvestment plan to participate. Once you are a member of the plans, you can choose to reinvest all, part or none of your dividends, and you will be able to make additional purchases of Praxair stock at your discretion. The minimum for these additional purchases is $50 per investment.

The fee structure of the plans is somewhat favorable to investors. Like many direct stock purchase or dividend reinvestment plans, there are no fees to purchase stock. However, you will be charged a variety of fees when selling your shares in the plans. These fees include a $5 handling fee per sale, along with any applicable brokerage fees. You can minimize fees by minimizing the number of sales transactions.

Helpful Links

Praxair’s Investor Relations Website

Current quote and financial summary for Praxair (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Praxair

I have always loved the industrial gasses as a long term dividend investment with APD in my portfolio and PX on my watch list for a long time. I have also been looking at ARG too. There’s no denying the past performance of PX along with the likelihood of its future growth as well as future dividend growth. Thanks for sharing this analysis.

Thanks for the comment, DivHut. I’m glad that you enjoyed the article.

Cheers,

Harvesting Dividends