Qualcomm manufactures and licenses technologies used throughout the mobile device industry. Photo: Freeimages.com/Eric Gross

About Qualcomm

Qualcomm develops and licenses technologies used in mobile phones and tablets, and in other wireless applications. The company also manufactures and markets products and services based on various digital communications technologies. Most of these products are integrated circuits and software used in mobile devices and in wireless networks, along with products used in wired devices. Qualcomm owns multiple intellectual properties for Code Division Multiple Access (CDMA) and Orthogonal Frequency Division Multiple Access (ODFMA) – both of which are used in cellular wireless communications. The company has its headquarters in San Diego, CA.

Qualcomm has three reportable segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL) and Qualcomm Strategic Initiatives (QSI). Qualcomm develops its products under the QCT segment, licenses them under the QTL segment, and makes strategic investments to expand the company’s opportunities through the QSI segment.

The company is reliant on a couple of large customers; it generally obtains 10% of its annual revenues each from Samsung Electronics and Apple supplier Hon Hai Precision Industry Co. Ltd.

The company is a member of the S&P 500 index and trades under the ticker symbol QCOM.

Qualcomm‘s Dividend and Stock Split History

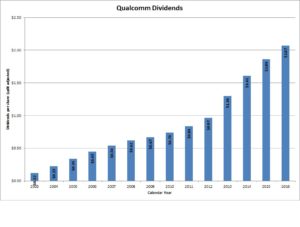

Qualcomm has grown dividends every year since 2003. Qualcomm stock pays dividends in March, June, September and December. The company generally announces dividend increases in April, with the stock going ex-dividend at the end of May. In April 2016, Qualcomm announced a 10.4% increase to its payout to an annual rate of $2.12 per share.

Qualcomm has an excellent record of dividend growth since 2003. Over the last 5 years Qualcomm has compounded the dividend at 19.91% annually. Over the past decade, the company has compounded the dividend at 16.49% annually. And since beginning to pay dividends in 2003, the company has grown dividends at an average rate of more than 24% a year.

Qualcomm has split its stock four times in its history, but only once since beginning to pay dividends in 2003. This was a 2-for-1 split in July 2004. The company also split its stock 2-for-1 in February 1994 and May 1999, and 4-for-1 in December 1999.

Over the 5 years ending on December 31, 2015, Qualcomm stock appreciated at an annualized rate of 2.11%, from a split-adjusted $43.81 to $48.64. This dramatically underperformed the 10.20% compounded return of the S&P 500 index over the same period.

Qualcomm’s Direct Purchase and Dividend Reinvestment Plans

Qualcomm has both direct purchase and dividend reinvestment plans. If you are not a current shareholder, you can participate in the plan with an initial purchase of $500. Once you are a plan participant, the minimum investment is $50. The dividend reinvestment plan allows for full or partial reinvestment of dividends.

Due to the fees, the plans are not necessarily favorable for investors. New plan participants will pay a $10 enrollment fee. For direct share purchases, you’ll pay a transaction fee of $1.50 (for monthly automatic direct debits) or $5 (for one-time purchases by automatic debit or check), plus an 8-cent per share commission. When you go to sell your shares, you’ll pay a transaction fee of between $15 and $25 (depending on the type of sell order you request), plus an 8-cent per share commission. All fees will be deducted from the sales proceeds.

Helpful Links

Qualcomm’ Investor Relations Website

Current quote and financial summary for Qualcomm (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Qualcomm