Photo: Flickr.com/Michael Carian

About The J. M. Smucker Company

The J. M. Smucker Company is a manufacturer and marketer of several well-known food brands. The company dates back to 1897 when Jerome Monroe Smucker established a mill to manufacture apple cider in Orrville, Ohio. He would later go on to manufacture apple butter. The company was incorporated in Ohio in 1921 and now employs over 7,000 people worldwide.

Smucker’s is well known for its jellies, preserves and frozen sandwiches, but the company also owns several other popular brands. These include Jif peanut butter, Dickinson’s fruit spreads, Pillsbury baking goods, Meow Mix cat food, Crisco oil and vegetable shortening, and the Folgers and Millstone’s coffee brands. The company also manufactures Dunkin’ Donuts roasted and ground coffee under a licensing agreement in effect through the end of 2038.

A vast majority of Smucker’s sales are inside the United States – 92% of the company’s 2015 net sales came from within the United States. Most of the sales outside the United States are in Canada.

Smucker’s has 4 reportable business segments: U.S. Retail Coffee; U.S. Retail Consumer Foods; U.S. Retail Pet Foods; and International, Foodservice and Natural Foods. Each of the U.S. Retail Coffee and U.S. Retail Consumer Foods segments provided 37% of the company’s net sales in fiscal year (FY) 2015 (which ended April 30, 2015). Pet Foods provided 4% of FY 2015 sales and the International, Foodservice and Natural Foods segment provided 22% of FY 2015 sales. Going forward, the sales in the U.S. Retail Pet Foods segment should increase, as Smucker’s closed on the $5.9 billion acquisition of Big Heart Pet Brands on March 23, 2015. To complete the acquisition, the company issued 17.9 million shares of stock and took on additional debt.

In FY 2015, Smucker’s sales were up 1.5% to $5.69 billion. However, earnings were down 39% to $3.33 per share, due primarily to debt and other costs from the Big Heart acquisition. The drop in earnings appears to be temporary, as the company is seeing 40 – 50% increases in sales due to the acquisition of Big Heart, and is guiding full year EPS to $5.70 – $5.80 for fiscal year 2016. With the current annualized dividend of $2.68, this gives Smucker’s a payout ratio of roughly 47%.

According to the company’s press releases, going forward Smucker’s intends to focus on repaying its debt and maintaining the current dividend policy, along with investing in the business through capital expenditures. The company’s long-term objectives include increasing net sales by 6% and EPS by 8% a year.

Smucker’s has a share repurchase program, although the company does not plan on focusing on share repurchases while paying down the debt from the Big Heart acquisition. As of June 24, 2015, approximately 10 million shares remained available for repurchase, representing 8.4% of the company’s outstanding shares.

The company is a member of the S&P 500 index and trades under the ticker symbol SJM.

J. M. Smucker’s Dividend and Stock Split History

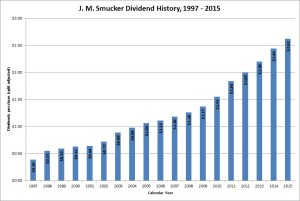

J. M. Smucker has paid dividends since 1960. Depending on how dividends are accounted for the company’s dividend growth record dates back to 1998 or to before 1990. The discrepancy comes from whether dividends are tracked by payout date or by record date. In 1997 – 1998, J. M. Smucker held its dividend flat for 8 consecutive quarters. S&P does not include J. M. Smucker as a S&P High Yield Dividend Aristocrat, even though the company could be considered to meet the criteria of 20 consecutive years of dividend growth.

The company announces annual dividend increases in mid-July, with the stock going ex-dividend in mid-August. J. M. Smucker announced a 4.7% dividend increase in July 2015, to an annualized rate of $2.68. The company should announce its next dividend increase in July 2016.

The company has established a decent record of dividend growth, with most recent year-over-year increases in the high single-digit or low double-digit percentages. Over the last 5 and 10 years, J. M. Smucker has compounded dividends at 11.07% and 9.47% respectively. Since 1998, the company has compounded dividends at 9.8% annually.

J. M. Smucker has not split its stock since 1990.

Over the 5 years ending on June 30, 2015, J. M. Smucker stock appreciated at an annualized rate of 15.31%, from a split-adjusted $52.55 to $107.11. This beat slightly the 14.96% compounded return of the S&P 500 index over the same period.

J. M. Smucker’s Direct Purchase and Dividend Reinvestment Plans

J. M. Smucker has both direct purchase and dividend reinvestment plans. You don’t need to be a current shareholder to participate in the plans – you can make your initial purchase through the plan. The minimum investment for the initial direct purchase is $250 and $25 for follow-on direct purchases. The dividend reinvestment plan allows for full or partial reinvestment of dividends.

The dividend reinvestment plan fees are favorable for investors, while the fees on direct purchases are less so. New investors will pay an initial fee of $10 plus a commission of 10 cents per share on their investment. Current plan participants pay a fee of $1.50 on automatic debits and $5 on one-time check or bank debits; in either case, there’s a commission of 10 cents per share. The company pays all the fees on reinvested dividends.

When you go to sell your stock in the plan, you’ll pay a transaction fee of either $10 or $25 (depending on the type of sell order) plus a commission of 10 cents per share sold. All fees will be deducted from the sales proceeds.

Helpful Links

J. M. Smucker’s Investor Relations Website

Current quote and financial summary for The J. M. Smucker Company (finviz.com)

Information on the direct purchase and dividend reinvestment plans for The J. M. Smucker Company