Tiffany & Co. sells high-end jewelry worldwide. Photo: Freeimages.com/Ramasamy Chidambaram

About Tiffany & Co.

Tiffany & Co. is the owner of the Tiffany brand, representing exclusivity and high quality. The company markets very high-end gemstone jewelry, which it manufactures or has made by others to precise specifications. Tiffany’s history dates back to 1837, when Charles Lewis Tiffany formed the company. The company considers the Tiffany brand, including its trademarked blue box, as its most valuable asset. Tiffany & Co. is headquartered in New York City.

Tiffany has more than 300 retail stores and reports results by geographical segment. The Americas segment has the largest number of stores and contributes about half of Tiffany’s worldwide sales, with sales from within the United States contributing about 45% of the company’s total worldwide sales. Tiffany also has a small but growing e-commerce sales channel, which provides about 6% of total sales.

The company is a member of the S&P 500 index and trades under the ticker symbol TIF.

Tiffany’s Dividend and Stock Split History

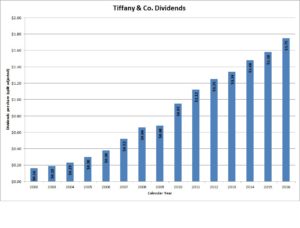

Tiffany has paid dividends continuously since 1988 and grown them every year since 2003. The company pays dividends in January, April, July and October, and generally announces dividend increases in May, with the stock going ex-dividend in June. In May 2016, Tiffany announced a 12.5% increase to its payout to an annual rate of $1.80 per share.

Tiffany has a good record of dividend growth, with a 5-year dividend growth average of 9.34% and a 10-year dividend growth average of 16.50%

Tiffany split its stock 2-for-1 in July 1996, July 1999 and July 2000.

Over the 5 years ending on December 31, 2015, Tiffany stock appreciated at an annualized rate of 6.01%, from a split-adjusted $55.91 to $74.84. This underperformed the 10.20% compounded return of the S&P 500 index over the same period.

Tiffany’s Direct Purchase and Dividend Reinvestment Plans

Tiffany has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in the plans. The initial investment must be at least $250, either in a single purchase or in 10 monthly purchases of $25 each. Additional purchases have a minimum of $25. Partial dividend reinvestment is permitted for owners of more than 100 shares of stock.

Due to their fees, the plans are not favorable for investors. There is a $15 fee to setup an account. For stock purchases, you’ll be charged a $5 fee for optional purchases by check and a $2 fee for automatic recurring purchases by direct debit. In addition to these transaction fees, all optional purchases are also assessed a 6-cent per share commission. For dividend reinvestments, you’ll pay this 6-cent per share commission. If you own more than 100 shares in the plan, you’ll also be assessed a transaction fee of 5% of the amount reinvested, up to $3. Tiffany pays the transaction fee for owners of less than 100 shares.

When you go to sell your shares, you’ll pay a transaction fee of either $15 or $25, depending on the type of sell order, plus a per share commission of 12 cents. If you place your sell order by telephone (instead of online), you’ll also pay a customer service fee of $15. All fees will be deducted from the sales proceeds.

Helpful Links

Tiffany & Co.’s Investor Relations Website

Current quote and financial summary for Tiffany & Co (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Tiffany & Co