Pratt & Whitney, which builds engines for commercial and military applications, is one of United Technologies Corporation's divisions. Photo courtesy Angelo DeSantis/flickr.com.

About United Technologies

United Technologies Corporation provides equipment and services to the construction and aerospace industries through its Otis; Climate, Controls & Security; Pratt & Whitney; Aerospace Systems; and Sikorsky business segments. United Technologies has its headquarters in Hartford, Connecticut and has over 212,000 employees around the world. Given the company’s business lines, United Technologies is heavily dependent on the health of the construction, aircraft and defense industries.

The Otis business segment is the world’s largest elevator and escalator manufacturing, installation and services company. The segment provides about 20% of United Technologies’ total sales and 40% of total profits. International operations provide roughly 80% of Otis’ sales.

The Climate, Controls & Security segment manufactures heating, ventilation and air conditioning under the Carrier and other brand names, and security and fire safety systems for residential, commercial, industrial and transportation applications. Examples include intruder alarms, access control systems, fire suppression and firefighting equipment and products. The segment contributes nearly 25% and 50% of total company sales and profits, respectively.

Pratt & Whitney supplies aircraft engines for the commercial, business and military aircraft markets. This segment also supplies spare parts and aftermarket maintenance services. Given the large expense of developing aircraft engines from scratch, part of Pratt & Whitney’s strategy includes collaboration agreements with industry partners. For example, Pratt & Whitney owns a 50% stake in Engine Alliance, which is a joint venture with GE Aviation. Engine Alliance manufactures the GP7000 engine for the Airbus A380 wide body aircraft.

The Aerospace Systems segment produces products for aircraft manufacturers, including aircraft subsystems like propellers, engine nacelles, actuation systems and landing gear. The segment also produces products and subsystems for space applications. The segment’s largest customers are Boeing and Airbus, which provide a combined total of 30% of segment sales. Sales to the U. S. Government come in second for 20% of the segment’s sales.

Finally, the Sikorsky business segment manufactures military and commercial helicopters, and provides aftermarket parts and services. Products include the UH-60M Black Hawk medium-transport helicopters, along with its service-specific variants. As you might imagine, sales to the U. S. Government are a large part of Sikorsky’s sales –more than 50% of total segment sales.

The company is a member of the S&P 500 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol UTX.

As a member of the S&P 500, once United Technologies has increased dividends for 25 consecutive years S&P will classify the company as an S&P Dividend Aristocrat. Given that United Technologies has made a conscious effort to increase the dividend each year for 23 years straight, I expect them to continue to do so. This would put them on track to become a Dividend Aristocrat at the beginning of 2019.

United Technologies’ Dividend and Stock Split History

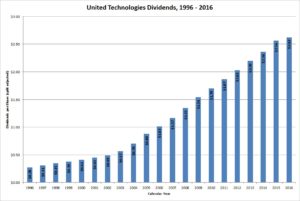

United Technologies has paid dividends each year since 1936 and grown its dividend payout since 1994. The company does not necessarily increase its dividend each year. Rather, for the past 10 years United Technologies has increased dividends every 5 quarters. United Technologies announced its most recent dividend increase at the beginning of May 2016 – a 3.1% increase to an annualized rate of $2.64. If the company holds to the pattern, the next dividend increase will be in August 2017.

The company has established a good record of dividend growth over the long-term. From 2003 – 2010, United Technologies grew its dividend by more than 10% each year and in most other years has increased dividends in the high single percentage digits. United Technologies has a 5-year compounded annual dividend growth rate of 7.03% and a 10-year rate of 9.95%. Since 1996, United Technologies has compounded dividends an average of 11.93% a year.

United Technologies Corporation has split its stock 4 times since beginning its record of dividend growth in 1994. Each of these splits was 2-for-1. The most recent stock split was in June 2005 and prior to that the company split its stock in June 1984, December 1996 and May 1999. You would now have 8 shares of United Technologies stock for each one you purchased when the company began growing its dividend in 1994.

United Technologies’ Direct Purchase and Dividend Reinvestment Plans

United Technologies has both direct purchase and dividend reinvestment plans. The plans have a fair amount of fees. Since Computershare administers the plans, you’ll pay a $10 fee to open a new account. When you directly purchase stock through the plan, you’ll pay a transaction fee of 5% of the purchase amount up to $2.50 (when you set up automatic investments), $3 (when you reinvest dividends) or $5 (when you make a single direct stock purchase), plus a 3-cent per share fee.

The minimum purchase amount is $250, either in a single purchase or at least 5 automatic deductions of $50. Additional direct purchases must be at least $50.

When you go to sell your shares in the plan, you’ll pay a fee of $15 or $25, depending on the type of sell order, and 12 cents per share sold. You will also be charged a customer service fee of $15 if you have your sell order processed over the phone by a customer service representative. In general, you can minimize fees by buying and selling shares in larger quantities.

Helpful Links

United Technologies’ Investor Relations Website

Current quote and financial summary for United Technologies (finviz.com)

Information on the direct purchase and dividend reinvestment plans for UTX

Want to find out about more great dividend growth stocks?

Check out the list of current S&P Dividend Aristocrats.