Photo courtesy takomabibelot/flickr.com.

About Universal Health Realty Income Trust

Universal Health Realty Income Trust is a real estate income trust (REIT) that owns 61 properties mostly serving the health care industry across 18 states. The company invests in health care and health and child care related facilities; the properties include 48 medical office buildings, 6 hospital facilities, 4 preschool and childcare centers, and 2 freestanding emergency departments. The company is headquartered in King of Prussia, Pennsylvania.

Universal Health Realty began operations in 1986 by purchasing properties from subsidiaries of United Health Services (UHS) and immediately leasing the properties back under initial terms of 13 – 15 years, with up to 6 additional 5-year terms. UHS and its subsidiaries is the company’s principal tenant and, as of December 31, 2014, UHS owned 5.9% of Universal Health Realty’s common stock. In addition to the wholly owned properties, each of which is organized into separate limited liability companies (LLCs), Universal Health Realty also has partial ownership interests in other LLCs; these interests are not included in the number of properties noted above.

The company had total revenues of $59.8 million in 2014, up 10.1% from 2013’s revenues. Funds from operations (FFO) in 2014, a common metric of financial health for REITs, were $35.9 million, up 2.8% from 2013. FFO per share were $2.78 in 2014, up 3 cents from the prior year. This gives the company a current payout ratio of 92.1% based on the current annualized dividend rate of $2.56.

In the 1st quarter of 2015, Universal Health Realty had FFO per share of 72 cents, up 2.9% from the same period in 2014. The company also completed two acquisitions during the 1st quarter: (1) two freestanding emergency departments located in Texas from UHS subsidiaries for $12.8 million and (2) a medical office park in Iowa for $4.1 million.

The company does not have a share repurchase program. Rather, Universal Health Realty periodically raises funds by selling common shares to and through Merrill Lynch. The program was initiated in late 2013 and allows for the selling of up to $50 million; as of the end of 2014, Universal Health Realty had sold over 580,000 shares, generating $25.6 million in net proceeds.

The company is a member of the Russell 2000 index and trades under the ticker symbol UHT. As of mid-July, UHT stock yielded 5.2%.

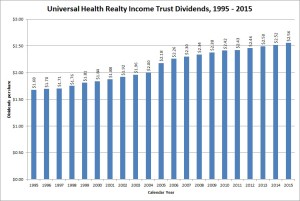

Universal Health Realty’s Dividend and Stock Split History

Universal Health Realty has paid dividends a year after beginning operations in 1986 and began increasing them the following year. The company does not increase dividends in a regular pattern, so it is difficult to predict its next increase. In the past, the company has gone 6 quarters without an increase and in other years has increased dividends twice. Universal Health has increased the quarterly dividend three times in the past 6 quarters, each time by half a cent. The most recent increase was in June 2015, when Universal Health raised the payout to an annualized $2.56.

Universal Health increases its dividend very slowly and has raised the quarterly payout by more than a penny only once, in 2005. Appropriately then, the dividend growth rate over time is low. Over the 5 and 10-year periods ending in 2015, the dividend growth rate is less than 1.65%. For the corresponding 20 and 25-year periods, the dividend growth rate is 2.1% and 2.2%, respectively.

Universal Health has not split its stock in its history.

Universal Health Realty’s Direct Purchase and Dividend Reinvestment Plans

Universal Health Realty Income Trust has both direct purchase and dividend reinvestment plans. You must already be an investor in Universal Health to participate in the plans. If you own shares of Universal Health Realty Income Trust stock in your brokerage account, you’ll have to have them transferred into your name in order to join the plans. The minimum investment for the direct purchase plan is $25 and the dividend reinvestment plan allows full or partial reinvestment of dividends.

The plans’ fee structures are favorable for investors, with the company picking up all costs on stock purchases. When you sell your shares, you’ll pay a transaction fee of $15, depending on the type of sell order you request, plus a commission of 12 cents per share. There’s an additional $5 fee to have the proceeds directly deposited to your account. All fees are deducted from the sales proceeds.

Helpful Links

Universal Health Realty’s Investor Relations Website

Current quote and financial summary for Universal Health Realty (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Universal Health Realty