Roughly a third of W. P. Carey adjusted base rent comes from the sale-leaseback of office buildings. Photo: Freeimages.com/dhaake.

About W. P. Carey

The W. P. Carey Company is a real estate investment trust (REIT) that specializes in sale-leaseback deals with commercial companies looking to divest their real estate and in build-to-suit deals. The company also has an investment arm that sponsors and partners with other companies to develop non-traded REITs for income generating investments. W. P. Carey has its headquarters in New York City and offices in Dallas, London, Amsterdam, Hong Kong, and Shanghai. William P. Carey founded the company in 1973 and took it public in 1998. The company converted to a REIT in 2012. W. P. Carey currently has about 272 employees worldwide.

W. P. Carey has two reportable business segments: the Real Estate Ownership segment and the Investment Management segment. The company receives roughly two-thirds of its revenues from the Real Estate Ownership segment and the remaining one-third from the Investment Management segment.

As of September 30, 2015, the company owns 854 properties in the Real Estate Ownership segment, serving 221 tenants in 19 countries. The real estate portfolio is mostly single-tenant properties, and most of the leases are for 10 -15 years with scheduled rent increases built in. As triple net leases, they also require the tenant to pay nearly all of the operating and maintenance costs associated with the properties. A further safeguard built into the leases is that most of them require the tenant to provide W. P. Carey with periodic financial statements to ensure the tenants continuing ability to meet the lease agreements. The 10 largest tenants produce over 31% of the company’s total base rent, with the largest contributors being German retailer Hellweg, American rental company U-Haul, the Spanish State of Andalucia, and hotel company Marriott.

Through the Investment Management segment, W. P. Carey acts as an advisor to a series of publicly owned, non-traded REITs. The company is responsible for raising the funds for the REITs, and for investing and managing the assets in the portfolio. The company has sponsored 18 investment REIT portfolios under the name Corporate Property Associates (CPA) since 1979; the latest portfolio is CPA: 18 – Global, which had its IPO in May 2013 and has $1.9 billion in assets under management. The company also serves as an advisor to the Carey Watermark Investors Incorporated (CWI) series of non-traded REITs, which focus on investing in lodging and lodging-related properties. Finally, W. P. Carey also recently invested $75 million in the Carey Credit Income Fund (CCIF), a business development corporation formed in conjunction with Guggenheim Partners Investment Management, LLC.

In 2014, the last year for which full year financials are available, W. P. Carey generated $4.56 in funds from operations per share. This was an increase of 64% from 2013. The large increase was due to the merger of the properties in CPA: 16 into the W. P. Carey owned portfolio. In conjunction with the merger, the company took on another $750 million in additional debt and issued 30 million shares to raise capital. With a current annualized dividend of $3.86, the company’s payout ratio (based on funds from operations) is 85%.

As of November 2015, the company had $21.5 billion in assets under management. More than half was in owned real estate.

The company trades under the ticker symbol WPC.

W. P. Carey’s Dividend and Stock Split History

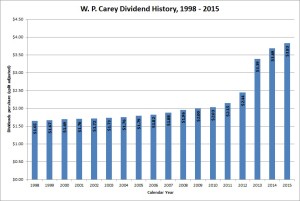

W. P. Carey has grown dividends year-over-year since coming public in 1998 and each quarter since 2001. In general, the quarterly dividend increase is less than a penny per share, and is payable to shareholders of record at the end of March, June, September, and December. The year-over-year dividend increase from 2014 to 2015 was 3.83%. At the end of 2015 the company’s annualized dividend was $3.86.

In general, W. P. Carey has a history of very slow dividend growth; in most years, the increase has been less than 2%. However, the company did dramatically increase its dividend from 2011 – 2013, which increases the company’s 5 and 10-year dividend growth rates. Over the 5 years ending in 2015, W. P. Carey compounded its dividend at a rate of 13.54% annually. Over the 10 years ending in 2015, the company compounded its dividend at a rate of 7.90%. Since beginning its record of dividend growth in 1998, W. P. Carey compounded the dividend at a rate of 5.07%.

W. P. Carey has not split its stock since coming public in 1998.

Over the 5 years ending on June 30, 2015, W. P. Carey stock appreciated at an annualized rate of 22.64%, from a split-adjusted $20.90 to $57.98. This dramatically beat the 14.96% compounded return of the S&P 500 index over the same period.

W. P. Carey’s Direct Purchase and Dividend Reinvestment Plans

W. P. Carey has both direct purchase and dividend reinvestment plans. In order to participate in the plans, you need to have at least one share registered in your name. If the shares are held in book form at a broker, you’ll have to contact your broker to have the shares transferred into your name. Once enrolled, the minimum investment for follow-on direct investments is $500. The dividend reinvestment plan allows for full or partial reinvestment of dividends.

The plans’ fees are very favorable for investors. The company covers all the costs of purchasing stock, whether directly or through dividend reinvestment. When you go to sell your stock in the plan, you’ll pay a transaction fee of between $15 and $30, plus a commission of 12 cents per share. You’ll pay a fee of $10 to have the proceeds directly deposited to your account and a fee of $15 if you use a customer service representative to place the sell order. All fees will be deducted from the sales proceeds.

Helpful Links

W. P. Carey’s Investor Relations Website

Current quote and financial summary for W. P. Carey (finviz.com)

Information on the direct purchase and dividend reinvestment plans for W. P. Carey