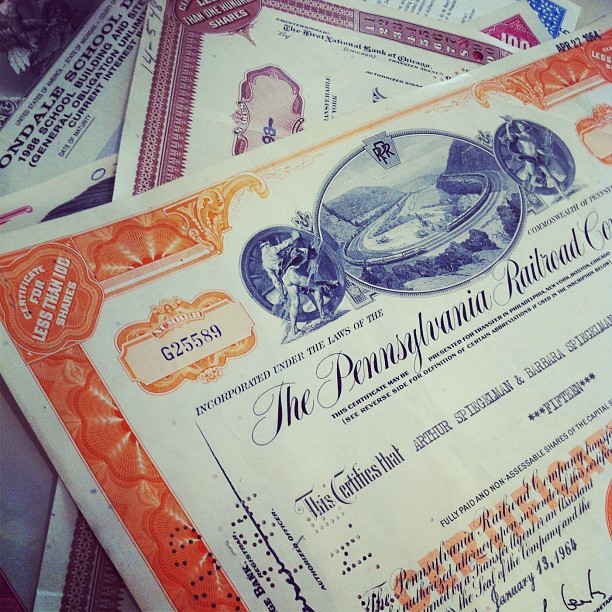

Photo: Flickr.com/J. Money

I bet you’ve never heard of Ronald Read.

This Brattleboro, Vermont resident and WW II veteran worked as a gas station attendant for 25 years, retired, found that retirement didn’t suit him, and then worked as a janitor at JC Penney for another 17 years. He passed away on June 2, 2014 and his will divided his estate between the local library and hospital.

And how much do you think he managed to leave behind, working at as a gas station attendant and a janitor his whole life?

$8,000,000

Now, Mr. Read was a very frugal man – far more than I am. He barely spent any of his wealth and his hobbies were “investing and cutting wood”. I think that if I had that kind of bank account that I’d be traveling or enjoying at least a little of it.

But I bring Mr. Read up because of how he amassed his wealth.

He certainly didn’t make $8 million in salary over his lifetime.

When his attorney went through Mr. Read’s estate, he found a “five-inch-thick stack of stock certificates in a safe-deposit box”. Certificates of companies like Procter & Gamble, General Electric, JP Morgan Chase, Johnson & Johnson and CVS Health.

All of these are dividend companies and most have grown dividends for decades. (Some, like GE and JP Morgan Chase, grew dividends for a long time until they had to cut their dividends during the financial crisis of 2007 – 2008.) Ronald Read not only invested in these companies but he also reinvested the dividends. Over time, his wealth grew exponentially as the dividends increased and were able to buy even more shares, which led to larger dividend payments.

Stories like this help to remind us to stick to our dividend growth stock investing strategy: buy good companies that grow earnings and dividends consistently over time and reinvest the dividends. Most importantly, don’t try to overthink things and outsmart the market. (I’ve tried that and I can tell you that it’s extraordinarily difficult.)

Stick with the strategy and your local newspaper may write a story about you when you pass on.

(Here’s the original article from the Brattleboro Reformer News. Barry Ritholtz has an interesting list of lessons to learn from Mr. Read’s life.)

Like this post? My newsletter subscribers saw a version of this post more than a year before I put it up on the website. Subscribe for free and you’ll see information like this before the general public. And you’ll receive a copy of my Dividend Doublers special report!

I’ve read the story about Mr Read before — thanks for reminding me about this remarkable man. Its worth remembering! I’m sure there are more Mr Read’s out there. The book “The Millionaire Next Door” suggests there are many.