(Photo from cover of 2013 HCP Annual Report.)

About HCP, Inc.

HCP, Inc. is an integrated real estate investment trust (REIT) that focuses on healthcare properties in the United States. HCP’s properties and investments are valued at $21.8 billion of assets under management and are located in 46 of the 50 states. The three states with the top net operating income are California (20% of total NOI), Texas (10%) and Florida (9%).

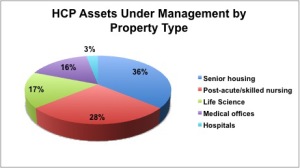

HCP Diversifies Across Property Types and Income Sources

HCP’s properties are diversified across 5 sectors:

- Senior housing, including independent living facilities, assisted living facilities and continuing care retirement communities, (444/20)

- Post-acute and skilled nursing, (302/0)

- Life science properties, e.g., medical business parks, (115/4)

- Medical offices, e.g., physician offices, pharmacies, outpatient surgical centers, diagnostic and laboratory facilities, and (272/66)

- Hospitals, including acute care and long-term acute care facilities, specialty surgical facilities and rehabilitation facilities. (20/4)

As of Dec 31, 2013 HCP had interests in over 1100 properties. These interests take the form of leased properties, mortgage and development loans, development and redevelopment projects, investment management with institutional investors, and operating properties.

HCP works with multiple operators and tenants. HCP derives the largest amount of its revenues from the following operators/tenants (all figures as of Dec 31, 2013):

- HCR Manor Care (29% of total 2013 revenues)

- Emeritus Corporation (13%)

- Brookdale Senior Living (8%)

- Sunrise Senior Living (5%)

All other operator/tenants each provide less than 5% of total revenues.

In its 2013 annual report, HCP reported revenues of $2.10 billion, up 11.7% from 2012, and income from continuing operations of $910.6 million, up 13.7% from 2012.

The company is a member of the S&P 500 index and trades under the ticker symbol HCP.

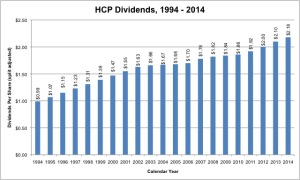

HCP’s Dividend and Stock Split History

HCP has increased dividends annually since 1986 and met the Dividend Aristocrat criteria of 25 straight years of dividend growth in 2010. Since 2004, HCP has increased its stock dividend in the 1st quarter of the calendar year. I expect HCP to announce its next dividend increase at the end of January and for the stock to go ex-dividend in early February.

HCP’s history of dividend growth has been fairly weak, with annual increases in the low single percentages. At the end of January, HCP increased its quarterly dividend by 3.8%, from 52.5 cents to 54.5 cents per share. The company’s 5-year compounded annual dividend growth rate (CADGR) is 3.45%, while its 10-year CADGR is 2.70%. The longer term growth rate is only slightly better with 20-year and 25-year CADGRs of 4.03% and 4.60%, respectively.

Since beginning its record of dividend growth in 1986, HCP stock has split twice. HCP split its stock 2-for-1 in May 1992 and March 2004.

Your investment in HCP, Inc. from mid-2009 to mid-2014 would have grown from about $16 to about $41 – a compounded rate of 20.26% over that time, not including the effects of reinvested dividends. This significantly beats the 14.3% return of the S&P 500 over that same period.

Tax Treatment of REIT Dividends

HCP distributes three types of dividends: (1) ordinary distributions, (2) capital gains distributions and (3) non-taxable distributions. The ordinary distributions are taxed as ordinary income, while the capital gains distributions (also known as qualified distributions) are taxed at your capital gains rate. The non-taxable distributions are a return of capital and reduce your cost basis in HCP stock. You’ll pay capital gains taxes when you sell your HCP stock and the reduction in your cost basis will increase your capital gains and your capital gains taxes.

Investopedia has a good summary of the different types of taxes, but be sure to work with your tax advisor when you pay taxes on HCP dividends and capital gains.

Direct Purchase and Dividend Reinvestment Plans

HCP, Inc. has both direct purchase and dividend reinvestment plans. If you’re interested in participating in either of these plans you can find information at Wells Fargo’s ShareownerOnline’s Investment Plan site. If you’re interested in directly purchasing HCP, Inc. stock, the minimum purchase is $750 for your initial purchase and $100 for subsequent purchases, whether investing by check or by automatic debit.

From a fee standpoint, HCP, Inc. has made the plans very friendly to investors. First, HCP’s plan offers a potential discount, ranging from 0 – 5% of the share price. Currently, HCP has set the discount at 1%. (Take note that HCP reserves the right to change the discount at any time.) The discount does not apply to stock purchased in the open market. In addition, there are no fees for purchasing shares through the direct purchase plan, as HCP, Inc. pays both the transaction and per share fees on your behalf. HCP, Inc. also pays all your fees for purchases when reinvesting dividends in additional shares.

When you go to sell your shares in the plan, you’ll pay a transaction fee of 10 cents per share. There’s a fee of $15 when selling your shares in a batch order or $25 if you request that your shares be sold in a market order. There’s also an electronic deposit fee of $5 if the funds are directly deposited to your account. The plan administrator deducts all the fees from the proceeds of the sale.

Helpful Links

HCP’s Investor Relations Website

Current quote and financial summary for HCP (finviz.com)

Information on the direct purchase and dividend reinvestment plans for HCP