Norfolk Southern operates 22,000 miles of railway lines in the United States. Photo: Flickr.com/Donald Lee Pardue

About Norfolk Southern Corporation

Norfolk Southern Corporation is the parent company for the Norfolk Southern Railway Company, which transports raw materials and finished products by rail primarily in the Southeastern, Midwestern and the Eastern Seaboard of the United States. Through agreements with other railway companies, Norfolk Southern also transports products to the rest of the United States, and overseas through multiple Atlantic and Gulf Coast ports.

Norfolk Southern’s rail network consists of over 20,000 miles of rail stretching from the Canadian border to Miami and as far west as Des Moines, Iowa; Kansas City, Kansas; and Dallas, TX. The products that Norfolk Southern transports can be divided into three major market groups: Coal, General Merchandise and Intermodal. The company further divides the General Merchandise category into Chemicals; Agriculture, Consumer Products and Government; Metals and Construction; Automotive; and Paper, Clay and Forest. The Coal, Chemicals, and Agricultural/Construction/Government segments each generate roughly a sixth of Norfolk Southern’s annual revenues. The Intermodal segment generates nearly a quarter of Norfolk Southern’s annual revenues.

Norfolk Southern’s primary competitor is CSX Corporation. The company also competes with trucking companies, water-borne carriers and other shippers.

The company is a member of the S&P 500 index and trades under the ticker symbol NSC.

As a member of the S&P 500, once Norfolk Southern has increased dividends for 25 consecutive years S&P will classify the company as an S&P Dividend Aristocrat. Given that Norfolk Southern has made a conscious effort to increase the dividend each year for 15 years straight, I expect them to continue to do so. This would put them on track to become a Dividend Aristocrat in 2026.

Norfolk Southern’s Dividend and Stock Split History

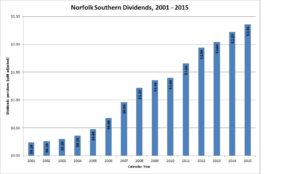

Norfolk Southern has paid dividends since at least 1983 and grown them since 2001, when the company cut the dividend by 70% during the economic downturn. From 2010 – 2014, the company increased the dividend every six months. However, Norfolk Southern has gone as long as 6 quarters without a dividend increase. The company’s last dividend increase was at the beginning of 2015, when Norfolk Southern raised the payout by 3.5% to an annual rate of $2.36.

Despite the modest increase in 2015, Norfolk Southern has a good record of dividend growth. Over the last 5 years, the company has compounded its dividend at 11.0% a year and over the last 10 years, the company has compounded its dividend an average of 17.3% a year.

Norfolk Southern has executed two stock splits over the last 30 years. Both stock splits were 3-for-1; they occurred in April 1987 and May 1997.

Over the 5 years ending on December 31, 2015, Norfolk Southern Corporation stock appreciated at an annualized rate of 8.82%, from a split-adjusted $54.95 to $83.84. This underperformed the 10.20% compounded return of the S&P 500 index over the same period.

Norfolk Southern’s Direct Purchase and Dividend Reinvestment Plans

Norfolk Southern has both direct purchase and dividend reinvestment plans. You do not need to be a current shareholder to participate in either plan – you can make your first investment through the direct purchase plan with an initial purchase of $250. Once you are a plan participant, you can make additional investments of at least $25. The dividend reinvestment plan allows for partial reinvestment of dividends.

The plans’ fee structures are very favorable for investors, as there are no fees assessed on purchases. When selling shares in the plan, you’ll pay a fee of $15 plus a commission of 7 cents per share. These fees will be deducted from the proceeds of the sale.

Helpful Links

Norfolk Southern Corporation’s Investor Relations Website

Current quote and financial summary for Norfolk Southern Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Norfolk Southern Corporation