Casey's General Store operates more than 1,900 convenience stores across the Midwestern United States. Photo: Flickr.com/Martin Braverboer

About Casey’s General Stores, Inc.

Casey’s General Stores operates over 1,800 convenience stores in the Midwestern United States under the name Casey’s General Store. The stores are located in communities that are not usually served by national convenience store chains, and store locations are chosen based on the local population and nearby highway traffic. More than half of the stores are located in towns with populations less than 5,000 people, while only 18% of the stores are in locations with populations of more than 20,000 people. In addition, more than half the stores are located in Iowa, Missouri and Illinois, with the remaining stores spread throughout Arkansas, Indiana, Kansas, Kentucky, Minnesota, Nebraska, North and South Dakota, Oklahoma, Tennessee and Wisconsin. Casey’s also operates 1 Tobacco City store in North Dakota. Casey’s has its headquarters in Ankeny, Iowa and has over 32,000 full and part-time employees.

The typical Casey’s store has 2,500 square feet dedicated to sales space and carries about 3,000 items, which are generally a mix of products that would be found in a supermarket. Most products are well-known national brands, although stores also carry regional brands of dairy products. Nearly all stores sell gasoline and diesel fuel under the Casey’s brand name. Casey’s stores also carry items like freshly baked pizza, donuts (the company installs donut making equipment in all newly constructed stores) and other bakery items, hamburgers, and made-to-order sub sandwiches.

While only about 30% of company sales come from non-fuel items, they generate more than 75% of total company profits, and the company is actively seeking to increase the sales of these high-margin products. Towards that end, the company is rolling out an online pizza and sub sandwich ordering and delivery service to many of its stores.

The company is a member of the S&P Small Cap 600 and Russell 2000 indices and trades under the ticker symbol CASY.

Casey’s General Stores’ Dividend and Stock Split History

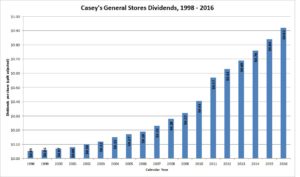

Casey’s General Stores has paid and grown dividends since 1990. The company generally announces dividend increases in June, with the stock going ex-dividend in early August. In June 2016, the company’s announced an 8.3% increase to its payout, to an annualized rate of 96 cents per share.

Casey’s has an outstanding record of dividend growth, although the dividend growth has been slowing recently. Dividend increases are usually greater than 10% and often much higher. The company has compounded the dividend at more then 10% a year over the last 5 years and by more than 17% over the last decade. Since its first full year of dividends in 1991, Casey’s has compounded its dividend at 21.62%.

Casey’s General Stores has split its stock 4 times since 1985. The first split, in June 1985, was a 3-for-2 split. The subsequent 3 splits – all 2-for-1 – occurred in August 1986, February 1994 and February 1998. A single share of stock purchased prior to June 1985 would now be 12 shares of stock.

Over the 5 years ending on December 31, 2015, Casey’s General Stores stock appreciated at an annualized rate of 24.38%, from a split-adjusted $40.39 to $120.22. This dramatically outperformed the 10.20% compounded return of the S&P 500 index, the 10.07% compounded return of the S&P Small Cap 600 index and 7.44% compounded return of the Russell 2000 over the same period.

Casey’s General Stores’ Direct Purchase and Dividend Reinvestment Plans

Casey’s General Stores has both direct purchase and dividend reinvestment plans. However, to participate in either plan, you must be a current shareholder. That means that you must own shares in your own name and not that of your brokerage (i.e., “in street name”). If you do own shares in a brokerage account, you’ll have to have them transferred into your name and then deposited into the plan to begin participating.

Once you’re a plan participant, the minimum for optional additional investments is $50.

The plans are very favorable for investors, as the fees for purchases and sales are minimal. There are no fees when you purchase shares through the plan, either directly or through dividend reinvestment. When you sell your shares in the plan, you’ll pay a fee of $5 per sell order along with a 10 cent per share commission. These fees will be deducted from the sales proceeds.

Helpful Links

Casey’s General Stores’ Investor Relations Website

Current quote and financial summary for Casey’s General Stores, Inc. (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Casey’s General Stores

I love learning about companies I’ve never heard of. Thanks for the review. Are you buying any shares?

Hi Investment Hunting:

I’m not buying any right now, but it’s on my watchlist. Given the current yield (~0.8%), and where the yield has ranged over the past decade or so (between 0.8% and 1.2%), I would look to start buying CASY in a decent size correction. Personally, I’d like to see a price closer to $80, instead of the current $115.

Thanks for the comment.

Cheers,

Jason