ONEOK is the sole general partner of ONEOK Partners, which manufactures and distributes natural gas and associated liquids across the center of the country. Photo: Freeimages.com/jarpur

About ONEOK

ONEOK is the sole general partner of ONEOK Partners, a master limited partnership that gathers, processes, stores, transports and markets natural gas and natural gas liquids (NGLs). ONEOK Partners owns one of the nation’s largest NGL systems, that connects NGL supplies in the Mid-Continent, Permian (western Texas and southeastern New Mexico) and Rocky Mountain regions to consumers. The bulk of ONEOK’s revenues come from dividends paid by ONEOK Partners. ONEOK also provides management and business resources to ONEOK Partners. ONEOK Partners trades publicly as a separate company from ONEOK under the ticker symbol OKS.

ONEOK Partners has three business segments: Natural Gas Gathering and Processing, Natural Gas Liquids, and Natural Gas Pipelines. The Natural Gas Gathering and Processing segment provides services – like removing contaminants from NGLs – to producers. The Natural Gas Liquids segment owns and operates facilities that gather, treat, store and distribute NGLs, and has partial ownership in several pipeline companies. The Natural Gas Pipelines segment provides transportation and storage services to end users through its storage facilities, and interstate and intrastate pipelines.

Direct ownership of ONEOK stock allows investors to receive the rewards of investing in a dividend growth stock, without the tax impacts of direct ownership in a Master Limited Partnership.

The company is a member of the S&P 500 index and trades under the ticker symbol OKE.

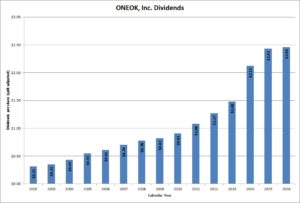

ONEOK’s Dividend and Stock Split History

ONEOK has paid dividends every year since 1972 and grown them every year since 2003. ONEOK stock goes ex-dividend in February, May, August and November. The company does not increase dividends on a regular schedule. ONEOK’s last dividend increase was in October 2016, when the company announced a 1.7% increase to its payout to an annual rate of $2.46 per share.

ONEOK has an excellent record of dividend growth since 2003. The company has compounded its dividend at 17.90% over the last 5 years and by 14.96% over the last 10 years.

ONEOK has split its stock four times, most recently a 2-for-1 split in June 2012. The company also split its stock 3-for-2 in December 1977, and 2-for-1 in February 1990 and May 2001. A single share of ONEOK stock purchased prior to December 1977 would now be 12 shares.

Over the 5 years ending on December 31, 2015, ONEOK stock appreciated at an annualized rate of 3.92%, from a split-adjusted $19.22 to $23.29. This dramatically underperformed the 10.20% compounded return of the S&P 500 index over the same period.

ONEOK’s Direct Purchase and Dividend Reinvestment Plans

ONEOK has both direct purchase and dividend reinvestment plans. If you are not a current shareholder, you can participate in the plan with an initial purchase of $250, either in one purchase or through 10 consecutive monthly investments of $50. Once you are a plan participant, the minimum investment is $25. The dividend reinvestment plan allows for full or partial reinvestment of dividends.

The plans are very favorable for investors. Aside from a $10 enrollment fee, there are no fees or commissions on purchases of shares, either directly or through dividend reinvestment. When you go to sell your shares, you’ll pay a transaction fee of between $15 and $30 (depending on the type of sell order you request), plus a 10-cent per share commission. There’s also a $5 fee to have the monies directly deposited into your account. All fees will be deducted from the sales proceeds.

Helpful Links

ONEOK’s Investor Relations Website

Current quote and financial summary for ONEOK (finviz.com)

Information on the direct purchase and dividend reinvestment plans for ONEOK