Questar produces and delivers natural gas to customers in the Rocky Mountains region of the United States. Photo from Questar Corporation website.

Note: Questar is in the process of being acquired by Dominion Resources.

About Questar Corporation

Questar Corporation is an integrated natural gas company that serves nearly 1 million customers in the Rocky Mountain region of the United States. The company is headquartered in Salt Lake City, UT and produces, transports and delivers natural gas to customers in Utah, Wyoming and Idaho.

The company’s history dates back to 1922, when one of Questar’s predecessor companies discovered natural gas in southwestern Wyoming. The first pipeline was laid in 1929, and the complete holdings were consolidated under the Mountain Fuel Supply Company in 1935. The Mountain Fuel Supply Company went public in 1961 and in the 1980s, was restructured and renamed “Questar Corporation”.

Questar has three main business lines: Questar Gas Company distributes gas to retail customers in the Rocky Mountain states of Utah, Wyoming and Idaho; Wexpro develops and produces natural gas for Questar Gas customers; and Questar Pipeline operates interstate natural gas pipelines and storage facilities.

Questar Gas Company had income in 2014 of $55.2 million, up 4.5% year-over-year, roughly a quarter of the total company income. In 2014, the segment’s customer base increased by less than 2% to about 962,000. Of note, in 2014, Questar Gas began the acquisition of the gas distribution system of the city of Eagle Mountain, UT from the municipality. The deal closed on March 1, 2015 following approval from the city council and will add 6,500 customers to Questar Gas.

Wexpro, the natural gas production segment of Questar, provided over 50% of Questar Corporation’s income in 2014. Net income was up 11.0% to $122.8 million. All of Wexpro’s production is sold to Questar Gas for the benefit of its customers. Production volume was up 7%, which contributed to the increase in net income.

Questar Pipeline’s income was flat year-over-year. At $60.6 million, this segment’s income was about a quarter of Questar Corporation’s 2014 income.

Adjusting 2013 income for a net asset impairment charge, total Questar Corporation 2014 income was up 6.0% to $226.5 million. Earnings per share were up 6.6% to $1.29.

In addition to the three business segments mentioned above, Questar Corporation also develops high-capacity compressed natural gas (CNG) fueling stations under the Questar Fueling subsidiary. The company operates 29 public CNG fueling stations in Utah and Wyoming, and is planning to open 7 additional fueling stations in Arizona, California, Colorado, Nevada, Texas and Utah in 2015. Most of these will be anchored by CNG fleet operators, providing Questar with a ready customer base once they open. Questar projects annual expenditures of $20 – 25 million going forward as they continue to open up additional CNG stations.

With regards to 2015, Questar is projecting that earnings per share will be in the $1.20 – $1.30 range, representing a decrease of up to 7%. The company also announced an increase in the dividend payout ratio target from 60% to 65%. Given that the current payout ratio (based on 2014 numbers) is 65%, I expect dividend growth going forward to be very slow.

The company is a member of the S&P 500 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol STR.

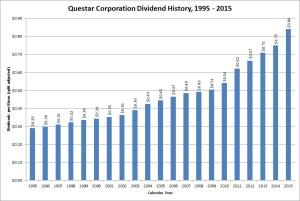

Questar Corporation’s Dividend and Stock Split History

Questar Corporation and its predecessor companies have increased dividends every year since 1973. Questar does not have a regular pattern of increasing dividends. Since 2007, Questar has increased dividends between every 3 to 5 quarters. The company’s last dividend increase was announced in February 2015 and the stock went ex-dividend at the end of February. This was the 43rd year of dividend increases for Questar.

Questar has established a record of moderate dividend increases. Since 2001, most of the increases have been in the mid-single digit percentage range, with occasional double-digit increases. Questar has built a 5-year compounded annual dividend growth rate (CADGR) record of 9.24%. The company’s 10-, 20- and 25-year CADGRs are lower: the 10-year CADGR is 6.56%, the 20-year CADGR is 5.46%, and the 25-year CADGR is 5.10%.

Since beginning its record of dividend growth in 1973, Questar has split its stock five times – in December 1974, August 1983, June 1991, June 1998 and June 2007. Each split was 2-for-1.

Over the 5 years ending on December 31, 2014, Questar stock appreciated at an annualized rate of 17.06%, from a split-adjusted $11.40 to $25.06. This outperformed both the 13.0% annualized return of the S&P 500 and the 14.9% annualized return of the S&P Mid Cap 400 index during this time.

Questar Corporation’s Direct Purchase and Dividend Reinvestment Plans

Questar Corporation has both direct purchase and dividend reinvestment plans. The dividend reinvestment plan allows for partial dividend reinvestment. The fee structure and required minimum investments are favorable for investors. The minimum direct purchase amount is $50 and the only cost that you’ll pay on shares that you buy through direct purchase or dividend reinvestment is a 6-cent per share commission. The fees to set up your participation in the plan as well as all other purchase fees are paid by Questar Corporation.

When you go to sell your shares, you’ll pay $15 as a transaction fee along with a 12-cent per share commission. There’s an additional $5 fee to have the proceeds directly deposited to your account.

Helpful Links

Questar Corporation’s Investor Relations Website

Current quote and financial summary for Questar Corporation (finviz.com)

Information on the direct purchase and dividend reinvestment plans for Questar Corporation