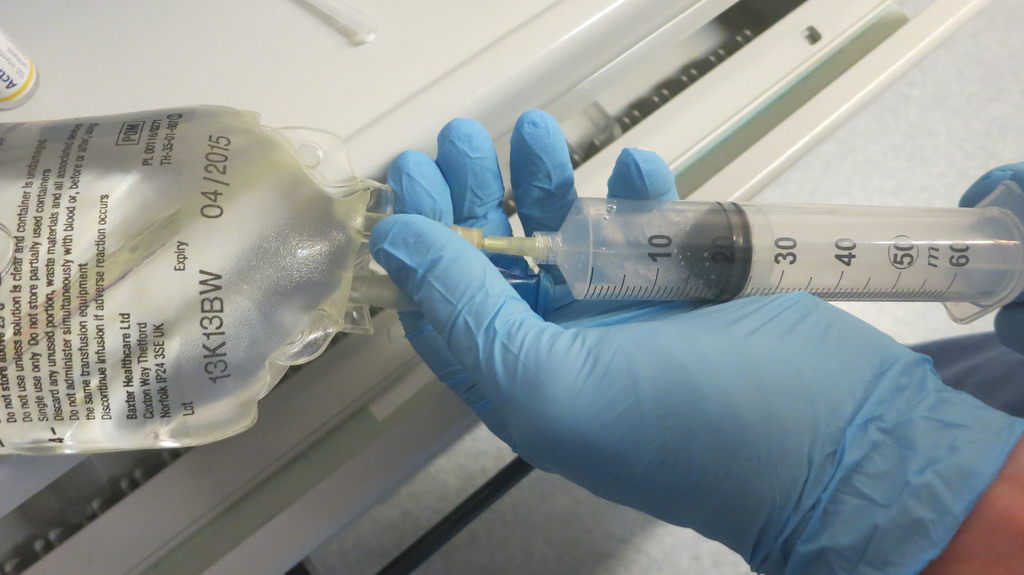

West Pharmaceutical Services manufactures drug packaging and delivery systems. Photo courtesy John Campbell/flickr.com.

About West Pharmaceutical Services

West Pharmaceutical Services designs and manufactures components and systems for packaging and delivering drugs. These include prefillable syringe components, components for intravenous (IV) and blood collection systems, and systems to improve healthcare worker safety. The company is headquartered in Pennsylvania and employs 7,000 people worldwide.

West Pharmaceuticals has two distinct business segments: the Packaging Systems segment and the Delivery Systems segment. The Packaging Systems segment is responsible for manufacturing and selling items like stoppers and seals for vials, components for syringes, along with the IV and blood collection components mentioned earlier. The segment’s products are marketed to pharmaceutical companies that produce branded and generic drugs. The segment provided over 70% of West Pharmaceuticals’ total sales in 2014.

The Delivery Systems segment manufactures and sells systems to enhance healthcare worker safety and to better administer drugs to patients. The segment also provides contract-manufacturing services for the healthcare industry. Most of the segment’s products are marketed to large pharmaceutical and medical device companies, and large personal care, food and beverage companies. Segment sales were up over 7% from 2013 to 2014; the segment generated nearly 30% of total company sales in 2014.

The company posted net sales of $1.4 billion and net income of $127.1 million in 2014, up nearly 4% and 13%, respectively. Net income per share was up 11.5% to $1.75, resulting in a payout ratio of about 25%.

West Pharmaceuticals has customers around the world and over half of the 2014 sales came from overseas, including 40% of sales coming from Europe, exposing the company to currency fluctuations from the Euro and other currencies. Without the currency effects, 2014 sales would have been higher by $5.5 million. The company projects that currency fluctuations will have a larger effect in 2015, reducing EPS by 18 – 20 cents.

West Pharmaceuticals also projects 2015 EPS will range between $1.74 – $1.92, an increase in the low teens, and that revenues will increase by about 5 – 7% over 2014 numbers.

With regards to share buybacks, West Pharmaceuticals authorized a $100 million share repurchase program in October 2014, to be completed by the end of 2015. As of December 31, 2014, no shares had been purchased under the program. With West Pharmaceutical’s current market share of $4 billion, this program represents 2.5% of the company’s outstanding stock.

The company is a member of the S&P Small Cap 600 index and S&P’s High Yield Dividend Aristocrats index, and trades under the ticker symbol WST.

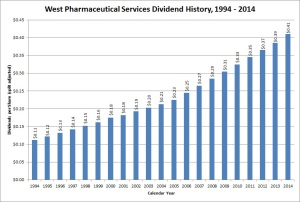

West Pharmaceutical Services’ Dividend and Stock Split History

West Pharmaceuticals has increased its dividend payout each year since 1993. The company has traditionally increased its dividend in the first quarter’s payment, announcing the increase in mid-December and having the stock go ex-dividend towards the end of January. However, most recently West Pharmaceuticals accelerated their dividend increase. The company announced a 9.1% increase in the quarterly dividend in July, to an annualized rate of 48 cents per share. I expect West Pharmaceuticals to announce its 25th annual dividend increase in July 2016.

The dividend increases over the last two years have been the largest for West Pharmaceuticals in the last two decades. Most of the company’s annual increases have been in the mid-single digit range, resulting in 5-year and 10-year compounded annual dividend growth rates (CADGRs) of 7.06% and 7.42%, respectively. Longer term, West’s 20-year CADGR is 6.83%.

West Pharmaceutical Services has split its stock 2-for-1 twice. The split occurred in September 2004 and most recently in September 2013. A single share of stock purchased prior to September 2004 would have split into 4 shares.

Over the 5 years ending on December 31, 2014, West Pharmaceutical Services stock appreciated at an annualized rate of 23.84%, from a split-adjusted $18.20 to $53.02. This dramatically outperformed both the 13.0% annualized return of the S&P 500 and the 15.9% annualized return of the S&P Small Cap 600 index during this time.

West Pharmaceutical Services’ Direct Purchase and Dividend Reinvestment Plans

West Pharmaceutical Services has both direct purchase and dividend reinvestment plans. You will need to be a current shareowner to participate in the direct purchase plan, which means that in order to participate in the plans, you must purchase shares of West Pharmaceuticals through a broker and have them transferred to the plan administrator, Broadridge Shareholder Services.

West Pharmaceuticals pays all fees on purchases made through the plan, either directly or through dividend reinvestment. When selling your shares in the plan, you’ll pay a transaction fee of $15 plus a commission of 10 cents per share.

Helpful Links

West Pharmaceutical Services’ Investor Relations Website

Current quote and financial summary forWest Pharmaceutical Services (finviz.com)

Information on the direct purchase and dividend reinvestment plans for West Pharmaceutical Services

Author’s note: I updated this post on July 17th to account for West Pharmaceutical’s acceleration of their 2015 dividend increase from October to July.